Multiple linear regression (MLR)

Sep 27, 2023

Announcements

- HW 02 due Mon, Oct 2 at 11:59pm.

- All lecture recordings available until Wed, Oct 4 at 9am.

- Click here for link to videos. You can also find the link in the navigation bar of the course website.

- Lab groups start this week. You will get your assigned group when you go to lab.

- Submit questions about SLR by Thu, Sep 28. These questions will be used to make the Exam Review. Click here for more info.

- Exam 01: Wed, Oct 4 (in-class + take-home)

- Exam 01 review: Mon, Oct 2

Computational setup

Considering multiple variables

Data: Peer-to-peer lender

Today’s data is a sample of 50 loans made through a peer-to-peer lending club. The data is in the loan50 data frame in the openintro R package.

# A tibble: 50 × 4

annual_income debt_to_income verified_income interest_rate

<dbl> <dbl> <fct> <dbl>

1 59000 0.558 Not Verified 10.9

2 60000 1.31 Not Verified 9.92

3 75000 1.06 Verified 26.3

4 75000 0.574 Not Verified 9.92

5 254000 0.238 Not Verified 9.43

6 67000 1.08 Source Verified 9.92

7 28800 0.0997 Source Verified 17.1

8 80000 0.351 Not Verified 6.08

9 34000 0.698 Not Verified 7.97

10 80000 0.167 Source Verified 12.6

# ℹ 40 more rowsVariables

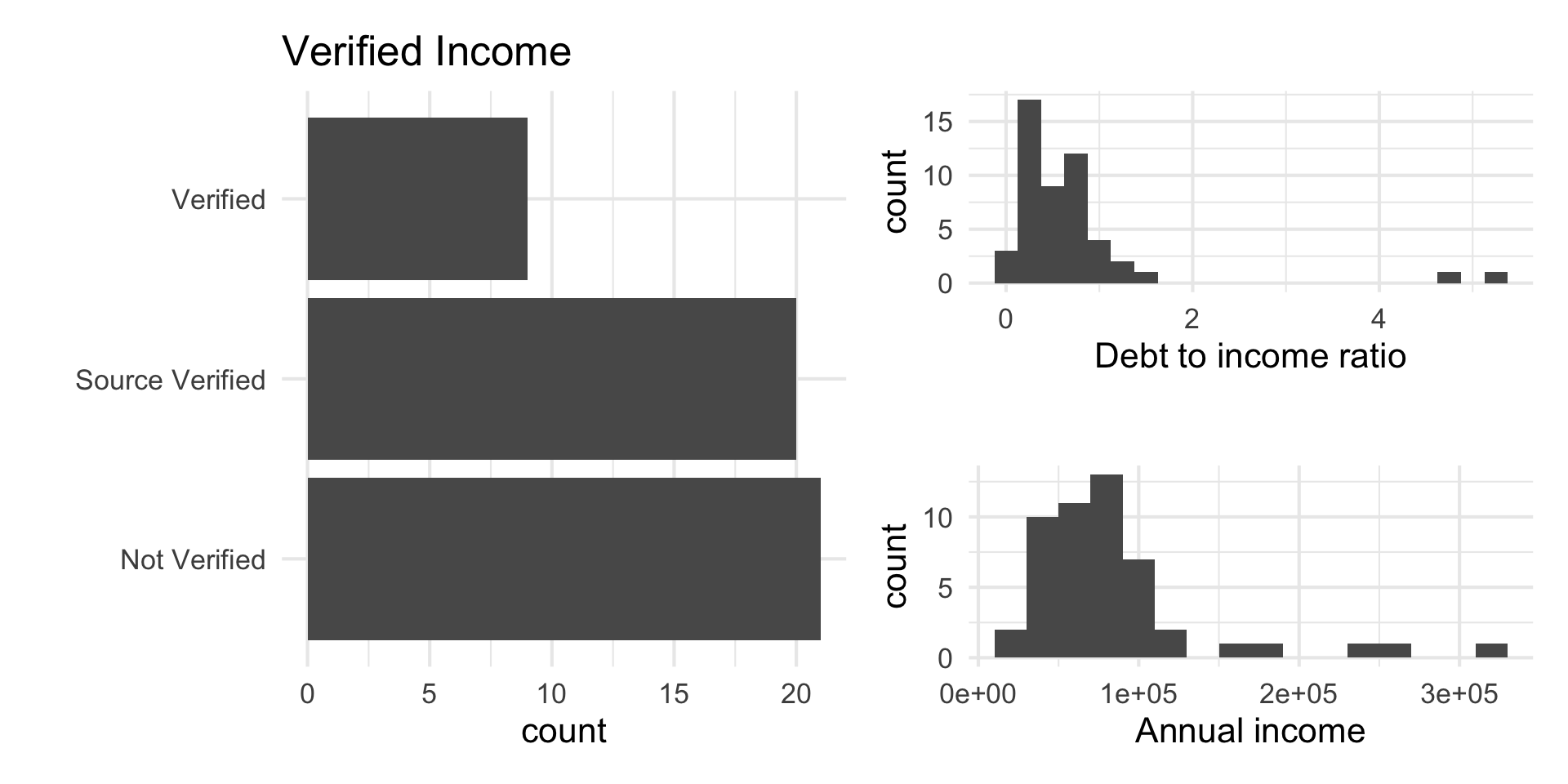

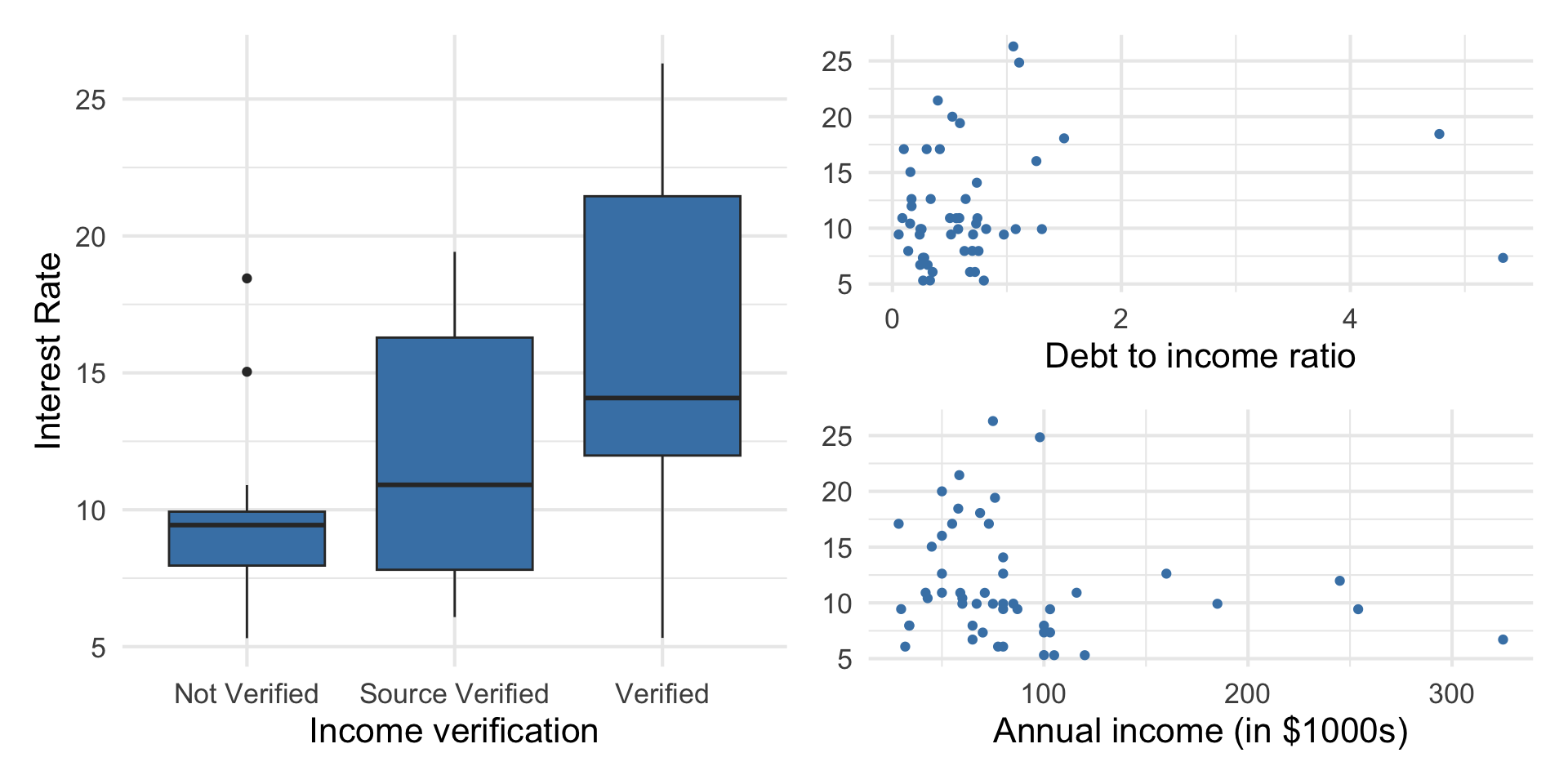

Predictors:

annual_income: Annual incomedebt_to_income: Debt-to-income ratio, i.e. the percentage of a borrower’s total debt divided by their total incomeverified_income: Whether borrower’s income source and amount have been verified (Not Verified,Source Verified,Verified)

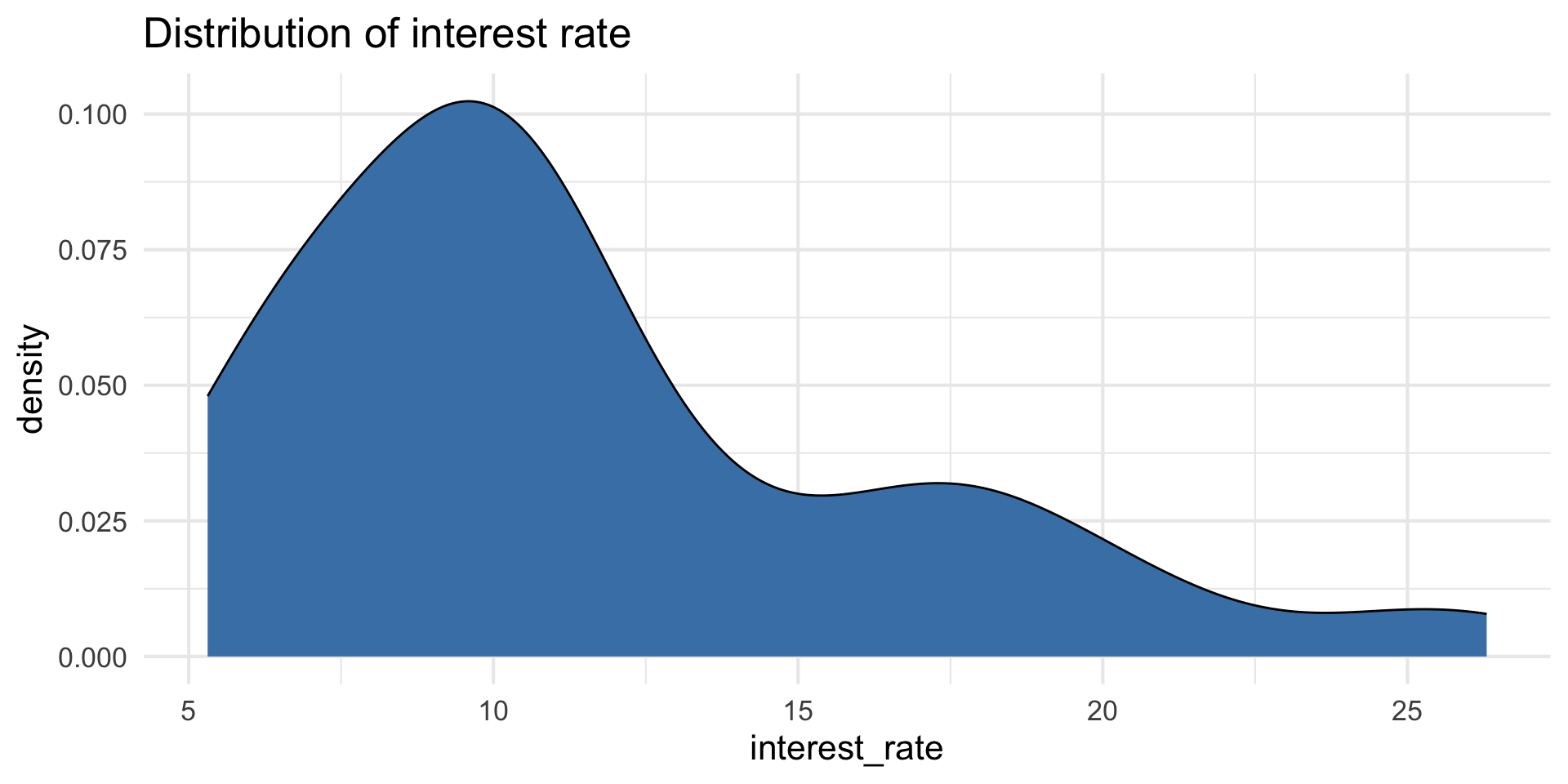

Outcome: interest_rate: Interest rate for the loan

Outcome: interest_rate

| min | median | max | iqr |

|---|---|---|---|

| 5.31 | 9.93 | 26.3 | 5.755 |

Predictors

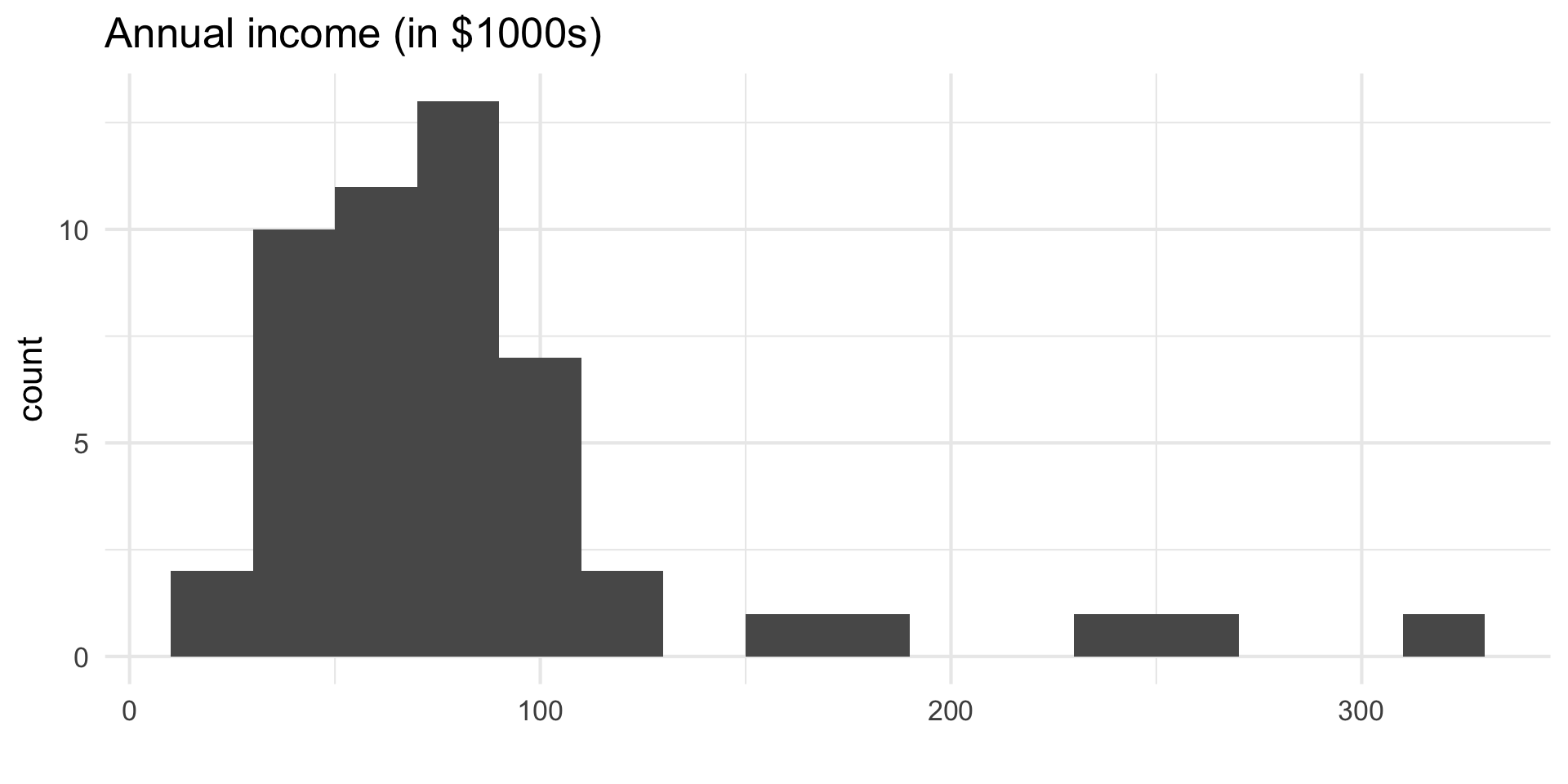

Data manipulation 1: Rescale income

Outcome vs. predictors

Single vs. multiple predictors

So far we’ve used a single predictor variable to understand variation in a quantitative response variable

Now we want to use multiple predictor variables to understand variation in a quantitative response variable

Multiple linear regression

Multiple linear regression (MLR)

Based on the analysis goals, we will use a multiple linear regression model of the following form

Similar to simple linear regression, this model assumes that at each combination of the predictor variables, the values interest_rate follow a Normal distribution.

Multiple linear regression

Recall: The simple linear regression model assumes

Similarly: The multiple linear regression model assumes

Multiple linear regression

At any combination of the predictors, the mean value of the response

Using multiple linear regression, we can estimate the mean response for any combination of predictors

Model fit

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 10.726 | 1.507 | 7.116 | 0.000 |

| debt_to_income | 0.671 | 0.676 | 0.993 | 0.326 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 |

| annual_income_th | -0.021 | 0.011 | -1.804 | 0.078 |

Model equation

Note

We will talk about why there are two terms in the model for verified_income shortly!

Interpreting

- The estimated coefficient

- Example: The estimated coefficient for

debt_to_incomeis 0.671. This means for each point in an borrower’s debt to income ratio, the interest rate on the loan is expected to be greater by 0.671%, holding annual income and income verification constant.

Prediction

What is the predicted interest rate for an borrower with an debt-to-income ratio of 0.558, whose income is not verified, and who has an annual income of $59,000?

The predicted interest rate for an borrower with with an debt-to-income ratio of 0.558, whose income is not verified, and who has an annual income of $59,000 is 9.86%.

Prediction, revisited

Just like with simple linear regression, we can use the predict() function in R to calculate the appropriate intervals for our predicted values:

new_borrower <- tibble(

debt_to_income = 0.558,

verified_income = "Not Verified",

annual_income_th = 59

)

predict(int_fit, new_borrower)# A tibble: 1 × 1

.pred

<dbl>

1 9.89Note

Difference in predicted value due to rounding the coefficients on the previous slide.

Confidence interval for

Calculate a 90% confidence interval for the estimated mean interest rate for borrowers with an debt-to-income ratio of 0.558, whose income is not verified, and who has an annual income of $59,000.

Prediction interval for

Calculate a 90% confidence interval for the predicted interest rate for an individual appllicant with an debt-to-income ratio of 0.558, whose income is not verified, and who has an annual income of $59,000.

Cautions

- Do not extrapolate! Because there are multiple predictor variables, there is the potential to extrapolate in many directions

- The multiple regression model only shows association, not causality

- To show causality, you must have a carefully designed experiment or carefully account for confounding variables in an observational study

Types of predictors

Interpreting results

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 10.726 | 1.507 | 7.116 | 0.000 | 7.690 | 13.762 |

| debt_to_income | 0.671 | 0.676 | 0.993 | 0.326 | -0.690 | 2.033 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 | -0.606 | 5.028 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 | 3.253 | 10.508 |

| annual_income_th | -0.021 | 0.011 | -1.804 | 0.078 | -0.043 | 0.002 |

Describe the subset of borrowers who are expected to get an interest rate of 10.726% based on our model. Is this interpretation meaningful? Why or why not?

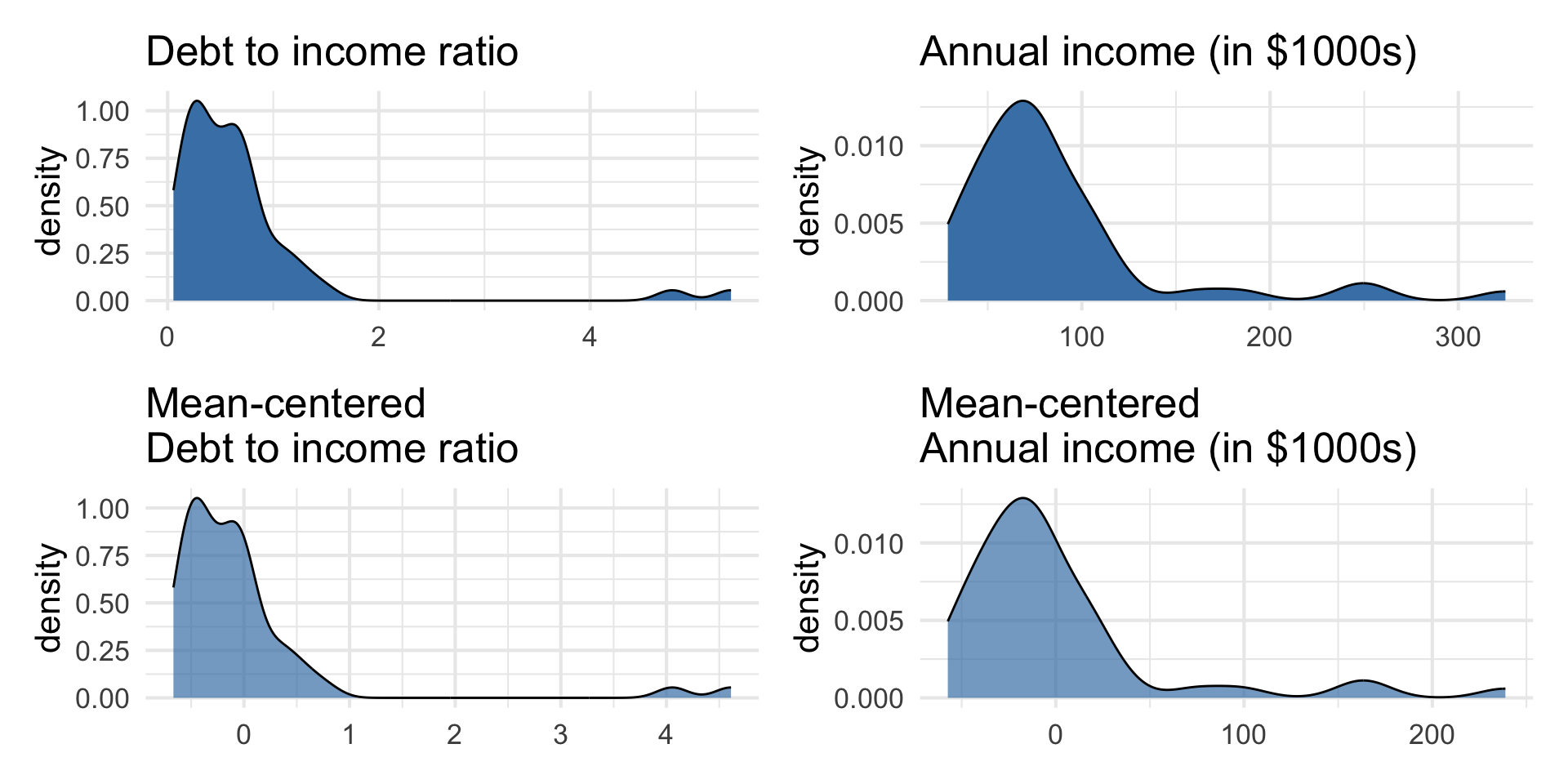

Mean-centered variables

Mean-centering

If we are interested in interpreting the intercept, we can mean-center the quantitative predictors in the model.

We can mean-center a quantitative predictor

If we mean-center all quantitative variables, then the intercept is interpreted as the expected value of the response variable when all quantitative variables are at their mean value.

Data manipulation 2: Mean-center numeric predictors

Visualize mean-centered predictors

Using mean-centered variables in the model

How do you expect the model to change if we use the debt_inc_cent and annual_income_cent in the model?

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 9.444 | 0.977 | 9.663 | 0.000 | 7.476 | 11.413 |

| debt_inc_cent | 0.671 | 0.676 | 0.993 | 0.326 | -0.690 | 2.033 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 | -0.606 | 5.028 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 | 3.253 | 10.508 |

| annual_income_th_cent | -0.021 | 0.011 | -1.804 | 0.078 | -0.043 | 0.002 |

Original vs. mean-centered model

| term | estimate |

|---|---|

| (Intercept) | 10.726 |

| debt_to_income | 0.671 |

| verified_incomeSource Verified | 2.211 |

| verified_incomeVerified | 6.880 |

| annual_income_th | -0.021 |

| term | estimate |

|---|---|

| (Intercept) | 9.444 |

| debt_inc_cent | 0.671 |

| verified_incomeSource Verified | 2.211 |

| verified_incomeVerified | 6.880 |

| annual_income_th_cent | -0.021 |

Indicator variables

Indicator variables

Suppose there is a categorical variable with

We can make

An indicator variable takes values 1 or 0

- 1 if the observation belongs to that category

- 0 if the observation does not belong to that category

Data manipulation 3: Create indicator variables for verified_income

# A tibble: 3 × 4

verified_income not_verified source_verified verified

<fct> <dbl> <dbl> <dbl>

1 Not Verified 1 0 0

2 Verified 0 0 1

3 Source Verified 0 1 0Indicators in the model

- We will use

- The baseline is the category that doesn’t have a term in the model.

- The coefficients of the indicator variables in the model are interpreted as the expected change in the response compared to the baseline, holding all other variables constant.

- This approach is also called dummy coding.

Interpreting verified_income

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 9.444 | 0.977 | 9.663 | 0.000 | 7.476 | 11.413 |

| debt_inc_cent | 0.671 | 0.676 | 0.993 | 0.326 | -0.690 | 2.033 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 | -0.606 | 5.028 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 | 3.253 | 10.508 |

| annual_income_th_cent | -0.021 | 0.011 | -1.804 | 0.078 | -0.043 | 0.002 |

- The baseline category is

Not verified. - People with source verified income are expected to take a loan with an interest rate that is 2.211% higher, on average, than the rate on loans to those whose income is not verified, holding all else constant.

Interpret the coefficient of Verified in the context of the data.

Interaction terms

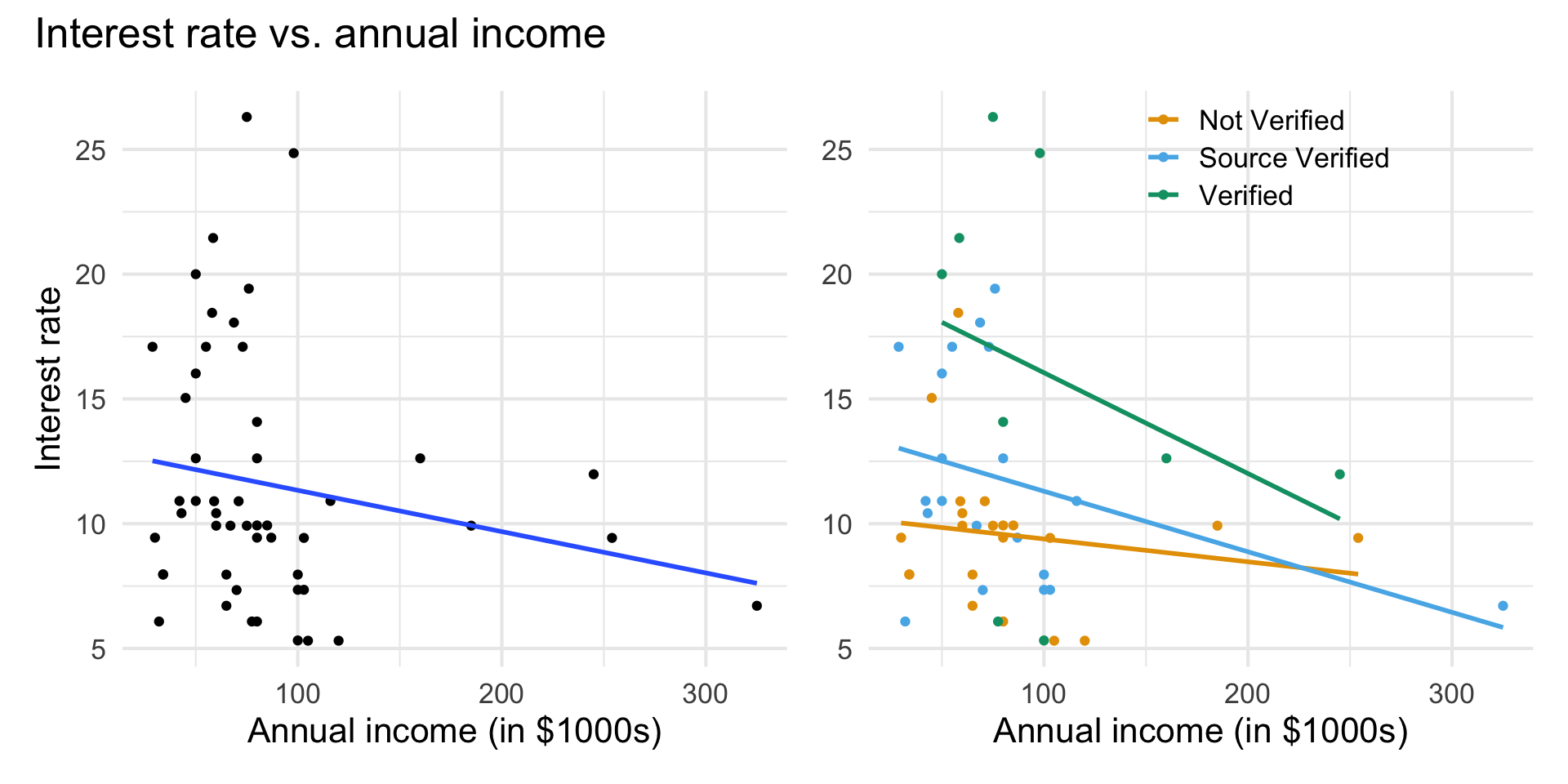

Interaction terms

- Sometimes the relationship between a predictor variable and the response depends on the value of another predictor variable.

- This is an interaction effect.

- To account for this, we can include interaction terms in the model.

Interest rate vs. annual income

The lines are not parallel indicating there is an interaction effect. The slope of annual income differs based on the income verification.

Interaction term in model

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 9.484 | 0.989 | 9.586 | 0.000 |

| debt_inc_cent | 0.691 | 0.685 | 1.009 | 0.319 |

| verified_incomeSource Verified | 2.157 | 1.418 | 1.522 | 0.135 |

| verified_incomeVerified | 7.181 | 1.870 | 3.840 | 0.000 |

| annual_income_th_cent | -0.007 | 0.020 | -0.341 | 0.735 |

| verified_incomeSource Verified:annual_income_th_cent | -0.016 | 0.026 | -0.643 | 0.523 |

| verified_incomeVerified:annual_income_th_cent | -0.032 | 0.033 | -0.979 | 0.333 |

Interpreting interaction terms

- What the interaction means: The effect of annual income on the interest rate differs by -0.016 when the income is source verified compared to when it is not verified, holding all else constant.

- Interpreting

annual_incomefor source verified: If the income is source verified, we expect the interest rate to decrease by 0.023% (-0.007 + -0.016) for each additional thousand dollars in annual income, holding all else constant.

Data manipulation 4: Create interaction variables

Defining the interaction variable in the model formula as verified_income * annual_income_th_cent is an implicit data manipulation step as well

Rows: 50

Columns: 9

$ `(Intercept)` <dbl> 1, 1, 1, 1, 1, …

$ debt_inc_cent <dbl> -0.16511719, 0.…

$ annual_income_th_cent <dbl> -27.17, -26.17,…

$ `verified_incomeNot Verified` <dbl> 1, 1, 0, 1, 1, …

$ `verified_incomeSource Verified` <dbl> 0, 0, 0, 0, 0, …

$ verified_incomeVerified <dbl> 0, 0, 1, 0, 0, …

$ `annual_income_th_cent:verified_incomeNot Verified` <dbl> -27.17, -26.17,…

$ `annual_income_th_cent:verified_incomeSource Verified` <dbl> 0.00, 0.00, 0.0…

$ `annual_income_th_cent:verified_incomeVerified` <dbl> 0.00, 0.00, -11…Wrap up

Recap

Introduced multiple linear regression

Interpreted coefficients in the multiple linear regression model

Calculated predictions and associated intervals for multiple linear regression models

Mean-centered quantitative predictors

Used indicator variables for categorical predictors

Used interaction terms

Looking backward

Data manipulation, with dplyr (from tidyverse):

loan50 |>

select(interest_rate, annual_income, debt_to_income, verified_income) |>

mutate(

# 1. rescale income

annual_income_th = annual_income / 1000,

# 2. mean-center quantitative predictors

debt_inc_cent = debt_to_income - mean(debt_to_income),

annual_income_th_cent = annual_income_th - mean(annual_income_th),

# 3. create dummy variables for verified_income

source_verified = if_else(verified_income == "Source Verified", 1, 0),

verified = if_else(verified_income == "Verified", 1, 0),

# 4. create interaction variables

`annual_income_th_cent:verified_incomeSource Verified` = annual_income_th_cent * source_verified,

`annual_income_th_cent:verified_incomeVerified` = annual_income_th_cent * verified

)Looking forward (after Exam 01)

Feature engineering, with recipes (from tidymodels):

loan_rec <- recipe( ~ ., data = loan50) |>

# 1. rescale income

step_mutate(annual_income_th = annual_income / 1000) |>

# 2. mean-center quantitative predictors

step_center(all_numeric_predictors()) |>

# 3. create dummy variables for verified_income

step_dummy(verified_income) |>

# 4. create interaction variables

step_interact(terms = ~ annual_income_th:verified_income)Recipe

── Recipe ──────────────────────────────────────────────────────────────────────── Inputs Number of variables by rolepredictor: 24── Operations • Variable mutation for: annual_income / 1000• Centering for: all_numeric_predictors()• Dummy variables from: verified_income• Interactions with: annual_income_th:verified_income